The Brazilian economy is going through a significantly challenging phase, which is severely affecting business and consumer sentiment.

Growth is supported by low inflation and interest rates, but will be negatively impacted by the ongoing contraction in neighbouring Argentina, its third largest export market.

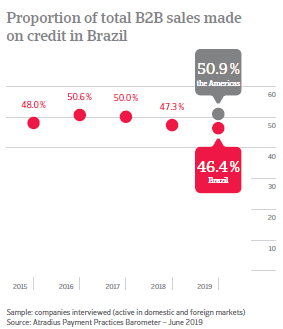

Respondents prefer selling to B2B customers on cash than on credit

Respondents in Brazil seem to prefer the safety of sales to their B2B customers on cash than on credit. Reflecting a heightened perception of the payment default risks connected with trading on credit, particularly abroad, the proportion of the total value of respondents’ credit-based sales decreased to 46.4% from 47.3% over the past year. The more cautious approach of Brazilian respondents to offering trade credit to B2B customers is consistent with their concerns about the credit quality of their commercial partners, which is expected to deteriorate over the coming months as anticipated by over 20% of respondents in the country. As the prospects for growth in Brazil appear to be less optimistic now than they were a few months ago, (also due to the increased uncertainties affecting the global trade environment) 2 in 5 respondents in the country anticipate potential liquidity shortfalls negatively affecting business growth. Again, this may explain respondents’ greater preference for the safety of cash sales.

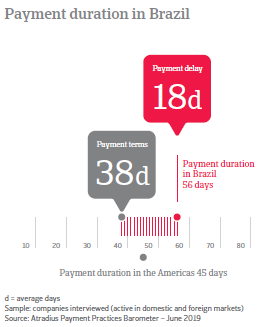

B2B payment terms are more relaxed than last year

Despite Brazilian respondents’ apparent preference for sales to B2B customers on cash, those respondents who offered credit terms gave customers far more time to pay than last year. Based on survey findings, average payment terms recorded in Brazil increased to 38 days from 32 days last year. This is consistent with the 37 days average recorded in Canada (up from 25 days last year).

Checking buyer’s creditworthiness and requesting secured forms of payment are the most used credit management practices in Brazil

Consistent with other countries surveyed in the Americas, the credit management policy of respondents in Brazil revolves around the prospective buyer’s creditworthiness, and its assessment prior to any trade credit decision. Survey findings reveal that Brazilian respondents (43%) perform checks of their customers’ creditworthiness more often than their peers in Mexico (38%), the US (35%) and Canada (30%). Moreover, in line with their relative preference for sales on cash, 37% of Brazilian respondents normally request secured forms of payment from B2B customers. Reserving against bad debts, which is aimed at ensuring financial stability of the company should the assessment of creditworthiness prove inaccurate, is done by 33% of Brazilian respondents. This credit management practice is used as often as in Canada, and less often in the US (28% of respondents citing this) and Mexico (18%). To protect cash flow from the negative impacts of currency volatility, 33% of respondents in Brazil reported they hedge against systematic exchange rate risk exposure.

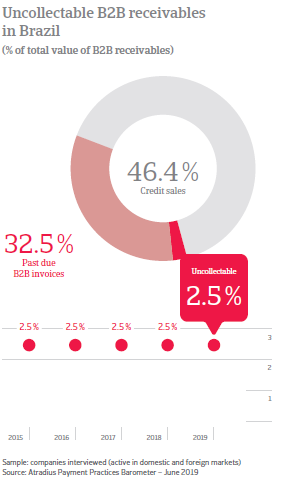

2 in 5 respondents needed to take measures to correct cash flow

32.5% of the total value of invoices issued by respondents in Brazil was reported to still be outstanding after the due date. This is the highest rate of late payments recorded of the countries surveyed in the Americas (24% in the US, 25.1% in Canada, and 26.6% in Mexico). On average, to turn these overdue invoices into cash it takes Brazilian respondents 56 days, less than the 59 days recorded last year. To alleviate the financial pressure on the business, most Brazilian respondents (43%) needed to take measures to correct cash flow, and 39% were forced to delay payment of invoices to their own suppliers. On average, 2.5% of the value of B2B receivables was written-off as uncollectable (no variation from last year).

Half of respondents expect B2B payment practices to improve over the coming months

Brazilian respondents appear to have an optimistic opinion about the future trend of B2B payment practices. 48% of respondents expect an improvement over the coming months. However, a sizeable 22% forecast an increase in slow-paying customers, with a subsequent increase in DSO. To ensure their company’s financial flexibility, and protect their business against the risk of payment default by their B2B customers, 35% of Brazilian respondents will check their B2B customers’ creditworthiness more often and 35% will retain a collections agency. 33% of Brazilian respondents reported they will perform dunning activities (outstanding invoices remainders) more often.

Overview of payment practices in Brazil

By business sector

Average payment terms longest in the consumer durables sector - shortest in the agri-food sector

Brazilian respondents from the consumer durables sector extended the longest average payment terms (averaging 50 days from the invoice date). Respondents in the agri-food sector set the shortest average payment terms (30 days).

Trade credit risk is highest in the Brazilian construction sector, and lowest in the metals sector

The value of overdue invoices is highest in the construction sector at 37% of the total value of B2B invoices. The ICT/electronics sector at 33% follows. The metals sector at 27% was lowest.

Proportion of uncollectable receivables highest in agri-food sector and lowest in the metals sector

The agri-food sector in Brazil reported that 2.8% of their B2B receivables were written off as uncollectable, the highest proportion in the country. The consumer durables sector followed at 2.6%. At the lower end of the scale, the metals sector reported an average of 1.1% of B2B receivables written off as uncollectable.

By business size

SMEs in Brazil set the longest, and large enterprises the shortest, average payment terms

Respondents from SMEs in Brazil extended the longest and those from large enterprises the shortest average payment terms to B2B customers (averaging 44 days and 30 days from the invoice date respectively).

SMEs in Brazil took the longest to collect overdue invoices

Despite a significant improvement in the payment behaviour of their customers over the past year, Brazilian SMEs appear to be the hardest hit by late payments with overdue invoices accounting for an average of 35.9% of the total value of B2B invoices. The average time it takes them to convert past due invoices into cash is 63 days, up from 61 days last year.

SMEs recorded the highest rate of uncollectable receivables

In line with the lengthening of their cash conversion cycle, Brazilian SMEs recorded the highest proportion of B2B receivables written off as uncollectable (2.6%). This compares to 2.5% in micro enterprises (up from, 1.8% last year) and to 2% in large enterprises (down from 2.5% one year ago).